Post issuance compliance is a complex arena with multiple facets to explanations. This is why almost all tax-exempt debt issuers rely on specialists to review the bond documents, related accounts, and complete these calculations.

There are TWO sets of rules that issuers must comply with: Arbitrage Rebate Rules AND Yield Restriction Rules.

Let’s try to keep this simple!

General Rules When it Comes to Capital Projects

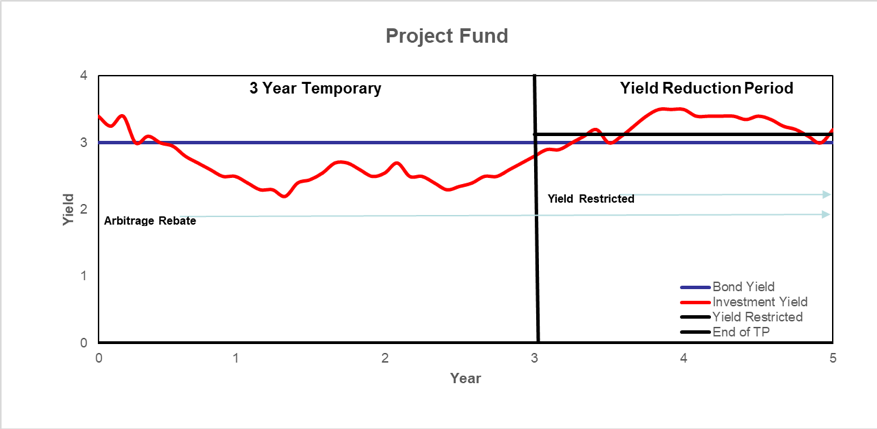

The federal government allows borrowing at tax exempt rates with certain expectations. First, the IRS expects the borrower to spend those loan or bond proceeds promptly. But if the project proceeds are held greater than 3 years from receipt, the outstanding project proceeds at that time are to be yield restricted and earn limited income. This is when the yield restriction calculation becomes a factor for capital projects compliance purposes.

Arbitrage Rebate?

Technically, ARBITRAGE is taxable investment earnings in excess of the declared tax-exempt bond yield which must be rebated to the Federal Government. The federal government doesn’t mind the issuer making money on its tax-exempt bond proceeds, but they do not want you to make a “profit” on those proceeds by not spending the debt on the projects they were issued for!

Arbitrage Rebate Calculations should be performed, at the latest, every 5 years over the life of the Issue.

“Well, I don’t think I should have to hire someone and spend money on this compliance rule!” you say? Issuers spend a lot of money to issue debt – bond attorneys, financial advisors, rating agencies, other professional services, etc. On-going post-issuance compliance is a small price over the life of the bond issue – and it is expected and required by regulation. Failure to comply with the rebate requirements could ultimately result in the loss of tax-exempt status on the issue, and financial penalties.

Yield Restriction?

Remember the general rule discussed above? The IRS provides a “Temporary Period” for Capital Projects of three years to spend those proceeds. Once the temporary period ends, project proceeds are “yield restricted” to its bond yield + .125%. If the interest earned on those proceeds is yielding above the bond yield + .125%, a yield reduction payment is due.

An Arbitrage Rebate Payment AND a Yield Reduction Payment?!

Let’s be clear… arbitrage rebate payments and yield restriction only become a hassle for the issuer when the tax-exempt proceeds are not spent promptly. Becoming familiar with your bond documents, and especially the Non-Arbitrage Certificate, can provide you spending benchmarks which can avoid these concerns. However, for those requiring calculations, the good news is that you do not owe BOTH payments! Only one payment is due, but the HIGHER amount is due.

Still have questions? Bingham has answers!

The more you understand about your rebate calculation, the better. Don’t hesitate to call a Bingham professional at (804) 288-5312 or send an email to info@bingham-ars.com for answers.