Arbitrage Rebate? It’s BACK!!

Everyone knows that investment and capital finance rates have increased dramatically in the last 15 months. There are many opinions as to when those rates will cease their upward trends, but one thing is certain – arbitrage rebate liabilities are back and suddenly what was OLD is NEW again! We wanted to share some of the questions we are receiving.

What is Arbitrage?

Under the U.S. Treasury Regulations issuers of tax-exempt bonds may not earn investment interest on bond proceeds (the “Taxable Rate”) that is in excess of the interest paid to the bondholders (the “Tax-Exempt Rate”). The difference in these rate spreads is called “arbitrage” and any arbitrage accrued must be paid to the Internal Revenue Service in the form of an arbitrage rebate payment.

How often is an arbitrage rebate calculation required?

Bond issues are due for compliance no later than the 5th anniversary of the bonds’ issuance date, and every 5th year thereafter. Even if your issue does not earn arbitrage, the calculation is required at least every five years as long as the issue is outstanding to provide proof to auditors that the issuer is compliant with the Internal Revenue Service’s requirements. We strongly recommend annual compliance reviews, if at all possible, to maximize the issuer’s efficiency and minimize the financial and time impacts of staff and document retrieval.

Arbitrage Rebate AND Yield Restriction?

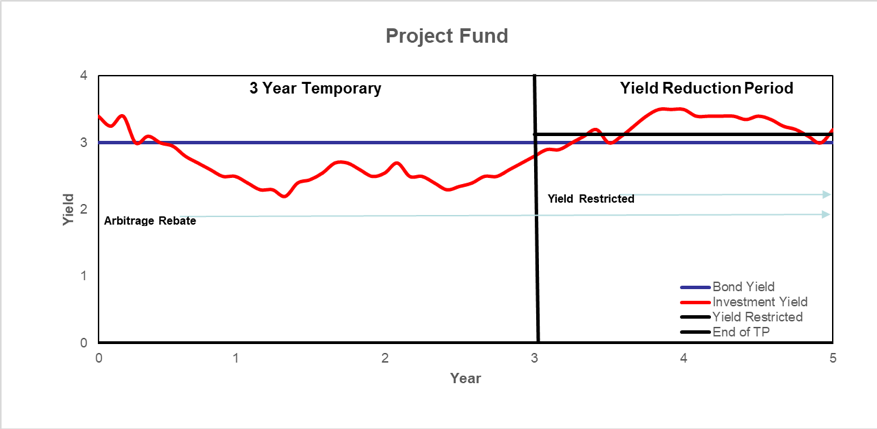

The IRS provides a “Temporary Period” for Capital Projects of three years to spend those proceeds. Once the temporary period ends, project proceeds are “yield restricted” to the bond yield + .125%. If the interest earned on those proceeds is yielding above the allowable amount, a yield reduction payment is due. As long as project proceeds remain unspent after 3 years, the issuer is required to make both calculations. Even if you qualify for a Small Issuer Exception, yield restriction STILL applies.

Are there any exceptions to a full calculation?

Yes! If you qualify as a Small Issuer – you are exempt from a full calculation for arbitrage rebate. However, you are not exempt from yield restriction rules. If you qualify as a Small Issuer, BUT your capital project proceeds remain outstanding beyond the Three-Year Temporary Period, you are required to have a yield reduction calculation completed.

Who qualifies for the Small Issuer Exception?

If a government entity with general taxing power, or a subordinate entity, issues $5 million or less in cumulative tax-exempt financings in one calendar year, they are exempt from the arbitrage rebate requirements. The Small Issuer Exception limits are increased to $15 million when at least $10 million is used to finance public schools. Please note, yield restriction rules still apply to Small Issuers.

What if all my proceeds have been spent in two years or less?

If you meet a spending exception, you do not need the calculation, and if you have earned arbitrage earnings, you get to keep those excess earnings. The spending exceptions are:

-

- 6 Month Exception

Spending 100% at 6 Months - 18-Month Exception

Spend 15% at 6 Months

Spend 60% at 12 Months

Spend 100% at 18 Months (5% reasonable retainage) - 2-Year Construction Exception

Spend 10% at 6 Months

Spend 45% at 12 Months

Spend 75% at 18 Months

Spend 100% at 24 Months (5% reasonable retainage)

- 6 Month Exception

Keep in mind that to qualify for the spending exception, each of the benchmarks must be met. Missing even one benchmark eliminates your exception and a full arbitrage rebate calculation is required.

My negative liability is becoming a positive arbitrage liability. Does that mean I will have to pay?!

Many issuers have become accustomed to seeing a negative arbitrage liability in their annual and installment calculations. The economy has changed dramatically over the last several years – and many issuers are now seeing their previous negative liabilities eroding to zero and/or turning positive. That means arbitrage earnings are now outpacing the allowed yield of return. Does that mean you will have to make a payment to the IRS? MAYBE! More importantly, it means your potential liability needs to be managed.

I’ll keep all my gross proceeds in a non-interest-bearing account so I won’t have to pay!

As a finance professional, that is certainly your option. However, not earning ANY investment earnings means your entity is losing out on that portion you CAN retain. AND if you meet a spending exception, the entity is allowed to retain ALL the interest earned on the debt proceeds. Consider that as a reward for planning and spending well! Arbitrage rebate compliance is not optional – it is required. If no interest is earned, that decision has actually cost your entity resources that could be used for other budgeted needs.

Can Bingham help me determine my potential rebate liability?

We would be honored to assist your entity prepare an evaluation for potential arbitrage rebate liabilities. Bond issuers large and small trust Bingham with their arbitrage rebate calculations. Our firm has performed calculations for a combined estimated $140 Billion in bond proceeds and has more than 1,500 active clients. Since 1988, we’ve handled issues valued from $150,000 to over $1 Billion for organizations including public utilities, municipalities, counties, states, public authorities, universities, public and charter school districts, airports, public-private partnerships (P3), retirement communities, and private issuers. Our account managers have compiled over 80 years of experience, bringing value, consistency, and individualized service to our clients. Consequently, Bingham has the specific knowledge and experience needed to ensure regulatory compliance and precision reporting for every client. We offer quick turnaround and highly attentive service.

Still have questions? Bingham has answers!

The more you understand about your rebate calculation, the better. Don’t hesitate to call a Bingham professional at (804) 288-5312 or send an email to [email protected] to open a line of conversation for answers.

Rising Rates Are Creating Arbitrage Rebate Liabilities!

Arbitrage Rebate is not a bad thing! It is also NOT a four-letter word! Many tax-exempt issuers have not worried about making substantial arbitrage rebate payments in nearly a generation of finance professionals. However, current investment rates continue to rise, and accompanying those rising rates are increasing arbitrage rebate liabilities and/or yield reduction liabilities. Of course, there are lots of questions - BUT there is no reason to panic! As with any liability, finance professionals manage to minimize the impacts and cash flows on their organizations. Key to these strategies is knowing how the liability can change over time. Bingham recommends several strategies which can help the finance professional tasked with this responsibility.

What is arbitrage rebate and Why is compliance reporting required?

Under the U.S. Treasury Regulations, issuers of tax-exempt bonds may not earn investment interest on bond proceeds (the “Taxable Rate”) that is in excess of the interest paid to the bondholders (the “Tax-Exempt Rate”). The difference in these rate spreads is called “arbitrage.” Internal Revenue Code Sections 103 and 148 (the sections referenced in the bond documents that are signed before you receive your tax-exempt debt proceeds) imposes investment restrictions on issuers of tax-exempt debt and requires those issuers to rebate or pay certain excess earnings (arbitrage) to the Internal Revenue Service in the form of an arbitrage rebate payment. Simply stated – it’s the law. It is essentially a 100% tax on the excess earnings and practically a financial disincentive to violate the rules.

Can I really owe a rebate payment when interest rates have been so low?

Historically low interest rates do not provide an excuse to avoid the issuer’s responsibility to complete calculations and monitor the spending of the debt proceeds. In fact, rebate payments still happen, often because of the even lower borrowing yields issuers have received in the same time period. The caution cannot be ignored – with the low yields of tax-exempt debt issued in the last several years, and as investment rates go up (and they have!), issuers will see rebate liabilities again when proceeds are not spent promptly. Many entities who issued during the last few years and have been unable to spend those proceeds for a variety of reasons (COVID-era, supply chain constriction, unavailable resources, etc.) are finding themselves with yield reduction payment liabilities - even when they have an overall negative arbitrage rebate liability. Yes-you can still owe for the yield reduction even if your arbitrage rebate calculation liability is negative. Good news though-you only pay once! Payment is made for the larger of the yield reduction or the arbitrage rebate. Bingham will prepare the required IRS Form 8038-T when it comes time to file at the end of the fifth year following debt issue.

My negative liability is becoming a positive arbitrage liability. Does that mean I will have to pay?!

Many issuers have become accustomed to seeing a negative arbitrage liability in their annual and installment calculations. The economy has changed dramatically over the last several years – and many issuers are now seeing their previous negative liabilities eroding to zero and/or turning positive. That means arbitrage earnings are now outpacing the allowed yield of return. Does that mean you will have to make a payment to the IRS? MAYBE! More importantly, it means your potential liability needs to be managed.

Where do I record the arbitrage rebate liability?

The potential arbitrage rebate liability is recorded as a current or long-term liability depending on the amount of time between the fiscal year end and the end of the installment period. Typically, this will be recorded in the capital project fund where the debt proceeds have been deposited and are being expended, for either governmental or enterprise fund types. As always, the finance officer will consider materiality thresholds when estimating and recording arbitrage rebate or yield reduction liabilities.

How do I record the arbitrage rebate liability?

There are two schools of thought in this question. Some issuers will record the rebate payment as an expense and an accrued liability. Other issuers will record the potential liability by deferring all or a portion of their investment returns earned in each fiscal period. Keep in mind that the rebate liability is occurring because of those current investment earnings. The amount of interest to defer is a matter of professional judgement. Issuers could even consider allocating the investment earnings between investment income and arbitrage rebate liability. In the current environment, the amount earned which exceeds the bond yield could be deferred from revenue and recorded instead to the balance sheet as an arbitrage rebate liability. The deferred earnings would accumulate on the entity’s balance sheet. An annual arbitrage rebate calculation report could then be used as a basis against which that account could be reconciled.

If I report an IRS payment to my Manager and/or Board, I’ll look like a bad finance officer!

Executives know the professional secret to managing bad news is to wrap it as good news! If you do have to (or choose to) report your IRS payment for arbitrage rebate, do so openly and with a smile on your face because you as the finance officer were prepared. “I am pleased to report that the entity’s investment program earned exceptional earnings, and we maximized the potential investment income we are allowed to retain. By law and regulations, the IRS does require that we return to them the excess earnings from our invested debt proceeds. We have had our earnings calculated by Bingham Arbitrage Rebate Services, our professional arbitrage rebate services firm. Because we have calculated those excess earnings annually, we have managed our income and potential liability each year as well. We have the funds set aside to make this payment without the need to request further appropriations from the governing body.” You should be able to pat yourself on the back for your job well done even if no one else will!

How much does arbitrage rebate compliance cost?

In the larger scheme of issuing debt, post-issuance compliance is not expensive. Arbitrage rebate calculation compliance services often cost less than many other services. Tax exempt debt requires post-issuance calculations until the gross proceeds are spent in full. Bingham customizes our service proposals to meet the requirements of each issue. Once Project proceeds have been fully expended, Bingham can finalize the calculation. Here is a word of caution - failure to meet the arbitrage rebate requirements could ultimately result in the loss of tax-exempt status on the issue, in addition to financial penalties.

What recommendations does Bingham share to make arbitrage rebate easier?

Bingham has a tried-and-true formula to make it easier. We have shared Six Easy Tips for a Smooth Arbitrage Rebate Calculation in our earlier website post here. A couple of key ideas:

- Know your exceptions. If your bond counsel advises you that your issue meets an exception, find out which one. The most common are: Small Issuer, Six Month, Eighteen Month, and Two Year. Bingham can review your statements and provide a report demonstrating your compliance.

- Keep your calculations current to be aware of the amount of arbitrage you are earning. This affords you the option to restructure your investments accordingly. Bingham recommends to our clients to have calculations performed annually which saves you time, effort, and has proven less costly over the years a calculation is required.

- Ask questions. The more you understand about your rebate calculation, the better. Don't hesitate to call a Bingham professional at (804) 288-5312 or send an email to [email protected] for answers.

Virginia Treasurer’s Department Awards Statewide Contract to Bingham

Following a competitive request for proposals, the Virginia Department of the Treasury recently announced Bingham Arbitrage Rebate Services, Inc. was again awarded an optional statewide contract to provide arbitrage rebate calculation services for the State’s public entities participating in Virginia’s State Non-Arbitrage Program (SNAP).

Kim Hoyt, President of Bingham Arbitrage, stated “We at Bingham are thrilled to continue our partnership with Virginia SNAP as their trusted arbitrage rebate provider! With decades of experience in the industry, our team has a deep understanding of the regulations and reporting requirements unique to Virginia. We are excited to continue working in our home state and to provide reliable and accurate calculations that help support the essential services the Virginia Treasury provides to their constituents.”

Virginia SNAP participants have ready access to the new contract which was effective beginning May 1, 2023. The Commonwealth of Virginia, counties, cities, and towns in the Commonwealth, and their agencies, institutions and authorities (“Virginia Issuers” or "Issuers") are all eligible to invest in the Program.

The Treasury Department’s announcement can be found at https://trs.virginia.gov/Bond-Finance/Arbitrage-Rebate-Calculation-Services. If you have questions about arbitrage rebate calculations, don’t hesitate to call a Bingham professional at 804-288-5312 or send an email to [email protected] for answers.

Best Practices for Arbitrage Rebate Compliance

Tax-exempt debt issuers must have a written post issuance compliance program as part of their debt management function, including using written practices for arbitrage rebate compliance. Failure to do so jeopardizes the issuer’s ability to access the tax-exempt capital markets! Infrequent issuers need to have similar procedures and practices. This article addresses some basic principles for an effective post issuance compliance program.

Yes – Written Procedures ARE Required

One of the documents signed at closing is the IRS Form 8038-G. On the second page, Line 44 says “If the Issuer has established written procedures to monitor the requirements of Section 148, check the box.” Many issuers do not examine the form that closely. Are you certifying there is a written program for compliance? This is too easy for the IRS to check! Do you want to risk sending a flag? While arbitrage rebate calculation can be complex, a written post issuance compliance program IS NOT COMPLEX!

The essentials of a written post issuance compliance program will include:

♦ Procedures are written (are you seeing a theme?)

♦ Educate staff for their responsibilities

♦ Place procedures where they are easily accessed

♦ Assign someone to be responsible

♦ Include documents covered and records retention

♦ Plan for succession

The last one is important! Why? Because many of you will retire or change jobs before the bonds being issued are paid off upon final maturity!

What Are Best Practices for Arbitrage Rebate Compliance?

The Internal Revenue Code was not written to be read easily. Honestly, some lawyers might admit they have trouble following and understanding it completely. That is why the interpretations of tax law are sometimes challenged and the Tax Court rules and clarifies their decisions. The following points will help a tax-exempt debt issuer prepare to meet the complexity of post-issuance compliance and arbitrage rebate compliance.

• Inform your Arbitrage Rebate Firm of changes to the Issue, such as a Refunding (Evaluation dates are sometimes affected)

• Maintain good records! Keep investment records, general ledger expenditure bond project transactions, trust statements for bond-related accounts (reserve funds, debt service funds), bond transcript, past arbitrage rebate calculations and reports

• Keep all records of tax-exempt issues at least 3-6 years after the bonds are paid in full (this is an IRS requirement)

• Conduct annual arbitrage compliance reviews

o On bond anniversary, or

o Right before or right after annual audit

Benefits include:

♣ Implement any changes timely

♣ Book liability if needed

♣ Less costly to make changes

♣ Records more accessible

♣ Minimal disruption to staff’s many other responsibilities

Compliance with arbitrage rebate and Internal Revenue Code Section 148 can be complicated. Even so, having written procedures is a simple and direct practice, and essential to good debt and financial management. If you are an issuer of tax-exempt debt, or an obligated party in a tax-exempt issue (from a conduit authority), consider the value of conferring with a professional outside agency that has demonstrated expertise with the complexities of arbitrage rebate compliance.

Is It Arbitrage Rebate? Or Yield Restriction?

Post issuance compliance is a complex arena with multiple facets to explanations. This is why almost all tax-exempt debt issuers rely on specialists to review the bond documents, related accounts, and complete these calculations.

There are TWO sets of rules that issuers must comply with: Arbitrage Rebate Rules AND Yield Restriction Rules.

Let’s try to keep this simple!

General Rules When it Comes to Capital Projects

The federal government allows borrowing at tax exempt rates with certain expectations. First, the IRS expects the borrower to spend those loan or bond proceeds promptly. But if the project proceeds are held greater than 3 years from receipt, the outstanding project proceeds at that time are to be yield restricted and earn limited income. This is when the yield restriction calculation becomes a factor for capital projects compliance purposes.

Arbitrage Rebate?

Technically, ARBITRAGE is taxable investment earnings in excess of the declared tax-exempt bond yield which must be rebated to the Federal Government. The federal government doesn’t mind the issuer making money on its tax-exempt bond proceeds, but they do not want you to make a “profit” on those proceeds by not spending the debt on the projects they were issued for!

Arbitrage Rebate Calculations should be performed, at the latest, every 5 years over the life of the Issue.

“Well, I don’t think I should have to hire someone and spend money on this compliance rule!” you say? Issuers spend a lot of money to issue debt – bond attorneys, financial advisors, rating agencies, other professional services, etc. On-going post-issuance compliance is a small price over the life of the bond issue – and it is expected and required by regulation. Failure to comply with the rebate requirements could ultimately result in the loss of tax-exempt status on the issue, and financial penalties.

Yield Restriction?

Remember the general rule discussed above? The IRS provides a “Temporary Period” for Capital Projects of three years to spend those proceeds. Once the temporary period ends, project proceeds are “yield restricted” to its bond yield + .125%. If the interest earned on those proceeds is yielding above the bond yield + .125%, a yield reduction payment is due.

An Arbitrage Rebate Payment AND a Yield Reduction Payment?!

Let’s be clear… arbitrage rebate payments and yield restriction only become a hassle for the issuer when the tax-exempt proceeds are not spent promptly. Becoming familiar with your bond documents, and especially the Non-Arbitrage Certificate, can provide you spending benchmarks which can avoid these concerns. However, for those requiring calculations, the good news is that you do not owe BOTH payments! Only one payment is due, but the HIGHER amount is due.

Still have questions? Bingham has answers!

The more you understand about your rebate calculation, the better. Don't hesitate to call a Bingham professional at (804) 288-5312 or send an email to [email protected] for answers.

Six Easy Tips for a Smooth Arbitrage Rebate Calculation

The Internal Revenue Code was not written to be read easily. Honestly, some lawyers might admit they have trouble following and understanding it completely. That’s why the interpretations of tax law are sometimes challenged and the Tax Court rules and clarifies with more specificity. Exactly how does a tax-exempt debt issuer prepare to meet the complexity of post-issuance compliance and arbitrage calculation?

Here’s some GOOD NEWS! Bingham has a tried and true formula to make it easier.

- Be familiar with your documents, especially the Non-Arbitrage Certificate in your bond documents binder.

- Create a file to avoid backtracking through five years of "cold" paper trails when it's time for calculation. You'll be ready for the arbitrage rebate calculation immediately after your bond closing and prepared for the written procedures required by the IRS Form 8038-G.

- Schedule your calculation by notifying Bingham at least 60 days before each fifth-year anniversary to avoid late payment interest charges.

- Know your exceptions. If your bond counsel advises you that your issue meets an exception, find out which one. The most common are: Small Issuer, Six Month, Eighteen Month, and Two Year. Bingham can review your statements and provide a report demonstrating your compliance.

- Keep your calculations current to be aware of the amount of arbitrage you are earning. This affords you the option to restructure your investments accordingly. Bingham recommends to our clients to have calculations performed annually which saves you time, effort, and has proven less costly over the years a calculation is required.

- Ask questions. The more you understand about your rebate calculation, the better. Don't hesitate to call a Bingham professional at (804) 288-5312 or send an email to [email protected] for answers.

Post Issuance Compliance in a Rising Interest Rate Environment

In recent years, low interest rates have essentially mitigated any realization of positive net yield from the investment of bond proceeds. However, arbitrage earnings are beginning to return after nearly a ten year absence. Are you and your organization adequately prepared?

Weeks, even months, of planning and negotiating go into issuing tax-exempt debt. After several meetings with bond counsel, financial advisors, and leadership teams, closing a bond issue can feel like the end of the process. At closing, a bond counsel opinion describes that interest on the bonds is properly excluded from the gross income of the bondholders. Counsel opinion is based upon a reasonable expectation that tax law requirements will be fulfilled throughout the life of the debt. Bond documents include pledges by issuers as to post-issuance tax law compliance. Yet costly mistakes can be made when tax-exempt issuers do not follow post-issuance compliance.

All tax-exempt bond issues must comply with two separate sets of post issuance requirements: arbitrage rebate and yield restriction. Both sets of rules limit earnings on the investment of tax-exempt bond proceeds. Federal arbitrage rules are designed to prevent issuers of tax-exempt debt from obtaining excessive or premature debt and profiting from the investment of bond proceeds. Under the arbitrage rebate rules, an issuer investing bond proceeds and earning a positive net yield on that investment may be required to rebate (i.e., pay) that positive yield to the United States Government. While arbitrage rebate requirements begin on the bond’s issue date, yield restriction requirements do not apply until the end of an applicable “temporary period,” which is three years for most project funds. It is important to note that the calculations for both arbitrage rebate and yield restriction are separate and do not offset each other.

The Internal Revenue Service believes procedures are important for an issuer to address tax rules effectively. Included among the procedures are:

- Due diligence review at regular intervals. The frequency and timing of due diligence reviews often depend upon the complexity of the issuer’s outstanding bond issues. Bingham Arbitrage Rebate Services, Inc. strongly recommends that reviews be conducted annually versus waiting until the installment date (typically five years). Less frequent reviews are not recommended because of the potential for discovering tax issues later when it may be more difficult to take needed corrective actions. The completion of annual reports provides time to set aside the accruing rebate amount and have the funds available for the installment due date. Annual reporting is also an integral part of an annual audit.

- Adequate record retention. A strong records retention program is critical to substantiate compliance and to ensure institutional memory. Bingham suggests that records be maintained throughout the life of the bonds plus three to six years.

To learn more about these and other post-issuance tax compliance procedures the IRS believes are important, please consult IRS Publication 5091, dated March 2016.

Proper planning will prevent unanticipated rebate payments. If you are prepared for the arbitrage rebate payment, you won’t be caught off guard and not ready for the payment. Also, pay closer attention to the allowable spending exceptions. If met, you most likely will be able to avoid a rebate payment and instead keep the arbitrage earnings.

Finally, if you are an issuer of tax-exempt bonds, or an obligated party in a tax-exempt issue, consider the value of conferring with an outside agency that has demonstrated expertise with the complexities of post issuance compliance.